A study conducted by Apartment List, a rental listing company, referenced in this Wall Street Journal article illuminates a very real tension at the heart of today’s housing market. The vast majority of millennials say they eventually plan to buy a home but the primary obstacle is they can’t afford it.

A study conducted by Apartment List, a rental listing company, referenced in this Wall Street Journal article illuminates a very real tension at the heart of today’s housing market. The vast majority of millennials say they eventually plan to buy a home but the primary obstacle is they can’t afford it.

The reasons young people are falling behind include student loan debt, rising rents and the slow starts many got to their careers during the recession. These reasons combined with the rapidly increasing cost to buy in many housing markets across the country is placing home ownership out of reach for this generation.

The real issue up for discussion here is the choice/ability to save. Some of the statistics in the article indicate that only a small percentage of Millennials are able to save enough for a 10% down payment in the next 3 years.

Take a quick look at the article and let me know what you think. Is it really too hard for this generation to save enough money to buy a house or are they choosing to “experience” life in lieu of making the sacrifices necessary to save?

WSJ-Millennials Want to Buy Homes but Aren’t Saving for Down Payments

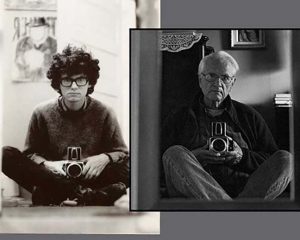

Knox Mortgage Team is pleased to announce we will be hosting Artist and Photographer Curtis A. Rhodes at the upcoming June 8th, 2017 Mill Creek Town Center Art Walk event. More about Curtis can be found at

Knox Mortgage Team is pleased to announce we will be hosting Artist and Photographer Curtis A. Rhodes at the upcoming June 8th, 2017 Mill Creek Town Center Art Walk event. More about Curtis can be found at  I came across

I came across

Going through the process to obtain a mortgage can be very overwhelming. Often, the most overwhelming aspect of a mortgage is the confusion surrounding certain terms and ideas. An idea to become especially familiar with is the notion of a “mortgage point”. The following article defines a mortgage point and highlights how to effectively use your knowledge of them in your hunt for the right mortgage loan.

Going through the process to obtain a mortgage can be very overwhelming. Often, the most overwhelming aspect of a mortgage is the confusion surrounding certain terms and ideas. An idea to become especially familiar with is the notion of a “mortgage point”. The following article defines a mortgage point and highlights how to effectively use your knowledge of them in your hunt for the right mortgage loan.

As most Americans these days, I have a small window opportunity every day to sit down and actually read about the news. With networks prioritizing news of tensions building up abroad, it was no surprise that the recent bill president Trump just signed to improve veterans health care fell below the news radar. The bill is meant to improve the program by removing the August 7th, 2017 expiration date. In a nutshell, the program allows veterans to utilize private health care if for certain reasons, the closest VA medical facility is not able to provide treatment within 30 days, the facility is more than 40 miles away from the member’s residence or travel to the facility for the member is too arduous. If not for the bill, this crucial program for our vets in need would have disappeared. Being in the Pacific Northwest, the geographical location of most veterans in need of treatment fall under at least two of the situations that qualify for this program. As a veteran myself, it is my duty to spread the word to as many people as I can to get awareness of this. If you are a veteran or know of one who may qualify for this, click

As most Americans these days, I have a small window opportunity every day to sit down and actually read about the news. With networks prioritizing news of tensions building up abroad, it was no surprise that the recent bill president Trump just signed to improve veterans health care fell below the news radar. The bill is meant to improve the program by removing the August 7th, 2017 expiration date. In a nutshell, the program allows veterans to utilize private health care if for certain reasons, the closest VA medical facility is not able to provide treatment within 30 days, the facility is more than 40 miles away from the member’s residence or travel to the facility for the member is too arduous. If not for the bill, this crucial program for our vets in need would have disappeared. Being in the Pacific Northwest, the geographical location of most veterans in need of treatment fall under at least two of the situations that qualify for this program. As a veteran myself, it is my duty to spread the word to as many people as I can to get awareness of this. If you are a veteran or know of one who may qualify for this, click